WELCOME TO

INTEGRITY

FINANCIAL PLANNING

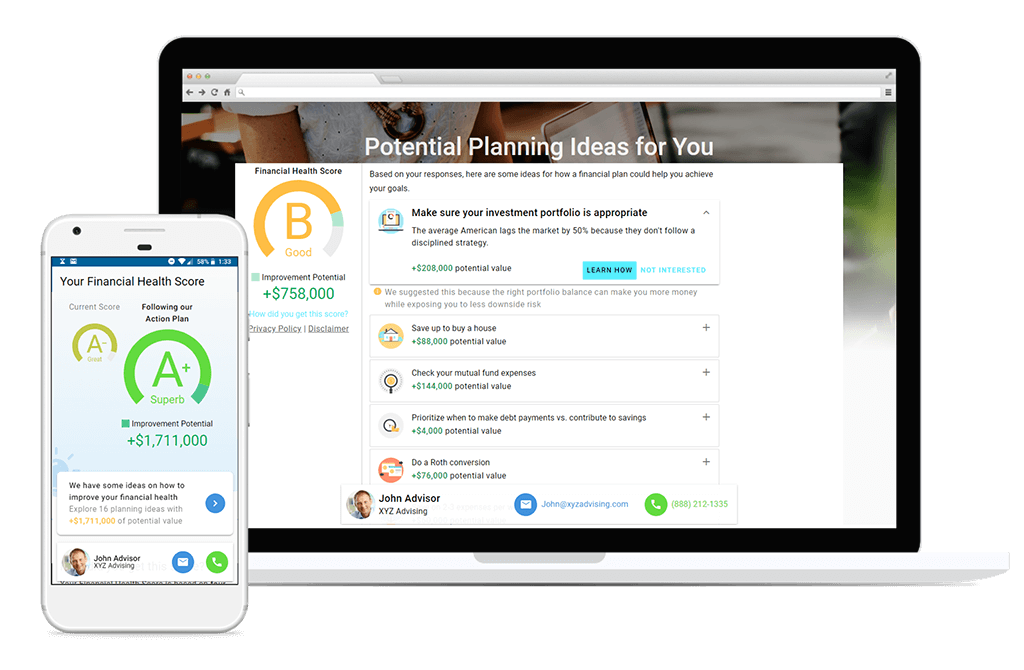

At Integrity Financial Planning, we act as financial coaches, helping our clients build retirement strategies that have the highest likelihood of helping them to retire with integrity. We are an independent registered investment advisor and fiduciary based in Roanoke, Virginia, servicing clients across the United States. We help high-net-worth individuals protect their retirement assets and develop creative strategies to assist in increasing their retirement income.

Our fiduciary duty ensures that we always have our clients’ best interests at heart. As independent financial advisors, we can help address a wide range of retirement goals, including but not limited to: Wealth Preservation and Protection, Tax Mitigation, Charitable Giving, Wealth Transfer and Private Wealth Management. Integrity Financial Planning utilizes each service in the client’s best interest with respect to their unique situation. We understand that there is no one-size-fits-all approach and customize plans for each client to ensure it meets their individual needs and risk tolerance.

As Featured In:

OUR FOUR PILLARS OF

INTEGRITY

Scroll over a pillar to learn more about each step of our process!

STEP 1: DISCOVERY

We start with a set of questions that will help us gain a deep understanding of who you are and what is important to you. We want to see your dreams and concerns from your perspective.

STEP 3: IMPLEMENTATION

Now, we begin executing these strategies to meet your future retirement goals. We’ll work together to execute the plan, including organizing your finances, making any workplace benefit adjustments, adopting an investment policy, and making strategic tax decisions.

STEP 4: ONGOING OPTIMIZATION

Through constant monitoring, we can integrate changes to your plan and help ensure that your plan continues to meet your needs.

STEP 2: PLANNING

After understanding your goals, we help design retirement strategies to fit your lifestyle and consider how each strategy impacts other concerns including taxation, opportunity cost, and risk tolerance.

Learn More